PMDP Rating Scale

The rating scale is meant as a best practice tool to aid managers and supervisors with the evaluation of employees.

File: PMDP-Rating.Scale_.pdfThe rating scale is meant as a best practice tool to aid managers and supervisors with the evaluation of employees.

File: PMDP-Rating.Scale_.pdf

This year the enrollment period is September 28-October 23, 2020, ending at 4:30pm 10/23. Remember to enroll or make changes to your 2021 benefits by 4:30 pm, Friday, October 23, 2020. (This is only needed if you want to make changes or enroll in benefits.)

1) Log into the MyUW portal at my.wisc.edu

2) Go to the Benefit Information tile

3) Click on the Enroll link

Or, see the email you received from UWSystemhr@uwsa.edu to learn more and follow the instructions to enroll.

Annual Benefits Enrollment is the only time you can make changes to certain benefits without having an eligible life event (for example, marriage, birth, or divorce) or qualifying employment change during the year.

Please use the benefits enrollment checklist to help you prepare, guide, and act.

See what changes are allowed during Annual Benefits Enrollment (ABE).

See the UW-Madison Office of Human Resources’ Annual Benefits Enrollment website for additional information and online pre-recorded enrollment events, “Benefits 2021: What You Need to Know”.

Watch one of the enrollment events if you need additional guidance in navigating your benefits enrollment.

Annual Benefits Enrollment is the only time you can make changes to certain benefits without having an eligible life event (for example, marriage, birth, or divorce) or qualifying employment change during the year. This year the enrollment period is September 28-October 23, 2020.

Please use the benefits enrollment checklist to help you prepare, guide, and act.

See what changes are allowed during Annual Benefits Enrollment (ABE).

See the UW-Madison Office of Human Resources’ Annual Benefits Enrollment website for additional information. There you will find a calendar of online enrollment events, “Benefits 2021: What You Need to Know” starting October 1, 2020.

Attend one of the enrollment events if you need additional guidance in navigating your benefits enrollment.

This year’s annual enrollment period is September 28 – October 23, 2020. See a preview of the Annual Benefits Enrollment (ABE).

Could you use a quick refresher on logging your furlough and leave? You’ve come to the right place.

Sections: Reminders | How to Enter Furlough and Leave | Frequently Asked Questions | Timing

Watch this helpful video (5 minutes) and follow along, or continue below for instructions.

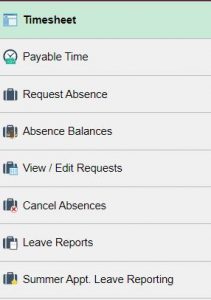

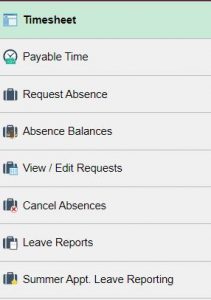

Academic Staff employees who are paid monthly must enter all time and absences through MyUW. This includes two parts: Part 1) Record furlough time in the Timesheet tab, and Part 2) Monthly leave reporting in the Request Absence tab. See overview instructions for each.

Record your furlough time right away during the week it is used.

1. Go to MyUW (my.wisc.edu) > Select TIME AND ABSENCE tile

2. Use TIMESHEET tab for entering the furlough day and hours worked for that week

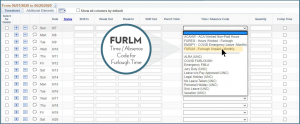

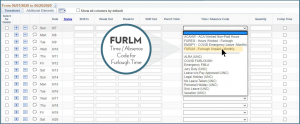

3. Find the Time/Absence Code dropdown menu

> Select the code FURLM for any full or partial furlough days (in Timesheet)

> Enter hours (as whole hour increments) under Quantity

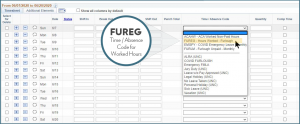

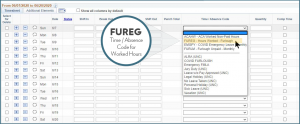

4. For the remainder of the days in that week, enter the FUREG code in the timesheet for hours worked during the same week. Enter FUREG hours worked (as whole hour increments) under Quantity.

Do not enter exact hours in the Shift In/Break Out/Break In/Shift Out columns.

5. Click “Submit” button.

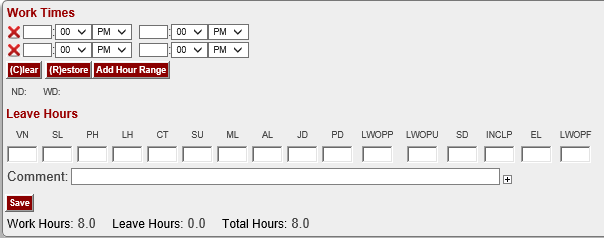

As a reminder, your furlough entry is not the only action required for the month. Enter your vacation, personal holiday, sick leave time, or “no leave taken” as follows:

Use the REQUEST ABSENCE tab to record your monthly leave usage, even if you did not take any leave days for the month.

Q: Do I need to log furlough in my monthly leave reporting (Absences in MyUW)?

A: No. Please do not use the furlough code or log furlough days in your monthly leave reporting.

Q: If my only days off in a given month were furlough days, do I still need to enter a “No Leave Taken”?

A: Yes. Furlough is different from Leave. Enter a No Leave Taken as you normally would in your Monthly Leave Reporting using the Request Absence tab on MyUW as shown above.

TIMING

TIMINGUpdated January 7, 2021

Furlough must be entered and approved by the following dates for Academic Staff in order for the furlough deduction to be taken in that month.

If you have questions on furlough entry, please email benefits@fpm.wisc.edu.

On June 29th, the Group Insurance Board (GIB) approved the following flexibility granted by the IRS due to the COVID-19 pandemic:

On June 29th, the Group Insurance Board (GIB) approved the following flexibility granted by the IRS due to the COVID-19 pandemic:

*Employees may only decrease their annual contribution to the amount already contributed or spent year-to-date, whichever is greater.

*If this guideline should change, we will notify HR Reps / HRS Coord. as soon as possible.

Beginning with the Fall 2020 semester, tuition reimbursements for FP&M employees will be limited to $2,500 per year. This means that FP&M will continue to reimburse tuition at 100 percent for any employee until this $2,500 limit is reached.

All current tuition reimbursement policies and processes remain in effect.

FP&M leadership continues to be committed to education and professional development for our employees. This strategy allows FP&M to continue to provide support for all eligible employees while addressing our current financial situation.

This yearly limit is provisional and will be re-evaluated during the fall semester once FP&M’s fiscal year 2021 budget situation becomes more clear.

You can also consider one of the other funding options available for UW-Madison employees.

If you have questions about this change or any current tuition reimbursement requests, please contact Kayla Ruplinger (kayla.ruplinger@wisc.edu).

Employees who are currently enrolled in the Dependent Care FSA (DCFSA) may make an Election Change Request.

The application must be received within 30 days of the closure and/or decrease in hours of the daycare location (or) within 30 days of the return to daycare.

Reason for Request: Change in Cost

Applications will be processed effective the 1stof the month on/following the receipt of the application.

There is no current change to FSA or DCFSA rollover guidelines.

A change is determined by IRS guidelines, Connect Your Care (CYC) and Employee Trust Funds (ETF)

Medical FSA: $500 Rollover

Dependent Care FSA: No funds may roll over

FSA contributions (with the exception of the standard $500 Medical FSA rollover) must be used prior to end of day 12/31/2020 or in cases of termination prior to 12/31/2020 –the last day of the month in which the last deduction occurred.

Supervisors and managers can approve Academic Staff’s time and furlough through the Time and Absence dashboard found on the MyUW Manager portal tile of MyUW (my.wisc.edu). The Payable Time Approvals section displays pending time approval requests, based upon the criteria, including date range, in Selection Criteria.

Academic Staff can record furlough in one-hour increments. Furlough must be reported in these whole hour increments using the code FURLM. Record the hours in the quantity field.

All other furlough guidelines for Academic Staff remain the same

Academic Staff employees who are paid monthly must enter all time and absences through MyUW. This includes two actions:

1) Record furlough time in the Timesheet tab, and 2) Monthly leave reporting in the Request Absence tab. See overview instructions for each, below.

You can also refer to this Academic Staff Job Aid for more detailed time entry instructions.

Record your furlough time right away during the week it is used.

1. Go to MyUW (my.wisc.edu) > Select TIME AND ABSENCE tile

2. Use TIMESHEET tab for entering the furlough day and hours worked for that week

3. Find the Time/Absence Code dropdown menu

> Select the code FURLM for any full or partial furlough days (in Timesheet)

> Enter hours (as whole hour increments) under Quantity

4. For the remainder of the days in that week, enter the FUREG code in the timesheet for hours worked during the same week. Enter FUREG hours worked (as whole hour increments) under Quantity.

Do not enter exact hours in the Shift In/Break Out/Break In/Shift Out columns.

5. Click “Submit” button.

As a reminder, your furlough entry is not the only action required for the month. Enter your vacation, personal holiday, sick leave time, or “no leave taken” as follows:

Use the REQUEST ABSENCE tab to record your monthly leave usage, even if you did not take any leave days for the month.

Click the Submit button in the upper right corner

Q: Do I need to log furlough in my monthly leave reporting (Absences in MyUW)?

A: No. Please do not use the furlough code or log furlough days in your monthly leave reporting.

Q: If my only days off in a given month were furlough days, do I still need to enter a “No Leave Taken”?

A: Yes. Furlough is different from Leave. Enter a No Leave Taken as you normally would in your Monthly Leave Reporting using the Request Absence tab on MyUW as shown above.

If you have questions on furlough entry, please email benefits@fpm.wisc.edu.

It is very important to log furlough days properly for compliance reasons. Logging furlough time is different for University Staff and Academic staff. See instructions for each, below. Also see important timing for all employees to be aware of, located at the end of this post.

Update 6/16/20: Academic staff are now able to record furlough in one-hour increments and must use different codes: refer to new information for Academic Staff to Log Their Furlough Time.

If you have questions on furlough entry, please email benefits@fpm.wisc.edu.

Updated 5/28/20

Employees may have questions about how recent events correlate with Flexible Spending Accounts (FSAs).

This communication will address some of the questions employees may have regarding these benefits.

At any time (not only in our current situation), if there is a unexpected change in child care location/situation (ie. daycare facility closes) and/or cost (ie. parent goes back to work – enrolling child in daycare), this does allow an employee to make changes to their Dependent Care Flexible Spending Account (DCFSA).

If the employee is now staying home with their child(ren) and the child(ren) are no longer in daycare, they may submit an Election Change Request within 30 days of the Qualifying Event: Change in Cost. The change will take place the 1st of the month on/following the receipt of the application.

This will also work vice versa. If the child(ren) should return to daycare, the employee may submit a new Election Change Request within 30 days of the Qualifying Event to reinstate/re-enroll in this benefit.

The Election Change Request may be completed electronically by the employee and submitted directly to FP&M Benefits.

Please note, this is not a required change; this is optional. If the employee(s) do not want to make a change; no action is needed.

At this time, there is not Qualifying Event in regards to the current events to enroll, change or cancel these contributions. The employee must have a standard Qualifying Event to make a change mid-year to the Medical FSA. If the employee is unsure of the Qualifying Events that are required, they may refer to the UW-System: Life Events Website.

YEAR-TO-DATE CONTRIBUTIONS

Unfortunately, at this time; we have not received further guidance on whether or not FSA (either Medical or Dependent Care) contributions would be eligible for rollover in 2021; more than the IRS guidelines currently allow. A change such as this is determine by the vendor, IRS guideline changes and the duration of the current events. We will continue to monitor the situation and work with UW-Shared Services and Connect Your Care (CYC) to determine any changes that may occur.

At this time, the current guidelines are still in effect and FSA contributions (with the exception of the standard $500 Medical FSA rollover) must be used prior to end of day 12/31/2020 or in cases of termination prior to 12/31/2020 – the last day of the month in which the last deduction occurred. To use the funds past a termination date (ie. last contribution), the employee would need to contribute the remaining balance of the annual election; which would allow the account to remain active (although no longer employed at UW) through the remainder of 2020.

Again, we will continue to monitor the current events and update you on any changes and/or allowances that may occur to these accounts.

Please contact FP&M Benefits if you have any questions (benefits@fpm.wisc.edu).

Take advantage of these free events. The UW Tax-Sheltered Annuity 403(b) Program is your supplemental retirement savings plan.

Take advantage of these free events. The UW Tax-Sheltered Annuity 403(b) Program is your supplemental retirement savings plan.

Individual counseling sessions are available by phone. Please see scheduling information below.

April 7, 2020

April 8, 202

April 27, 2020

April 28, 2020

May 5, 2020

May 6, 2020

May 12, 2020

June 16, 2020

June 17, 2020

June 30, 2020

To schedule an appointment, call 1-800-642-7131 or go to http://fidelity.com/atwork/reservations.

April 8, 2020

April 9, 2020

April 21, 2020

April 22, 2020

May 7, 2020

May 8, 2020

To schedule an appointment, call 1-800-732-8353 or go to www.TIAA.org/schedulenow

Lincoln has advisors in Madison at 406 Science Drive, Suite 310.

For a Lincoln appointment, call 608-238-8388

Ameriprise has advisors in Madison at 2601 West Beltline Hwy., Suite 104.

For an Ameriprise appointment, call 608-819-0500.

Rowe Price provides individual counseling sessions over the phone.

To speak to a T. Rowe Price representative, call 1-888-263-2899.

Webinars may be offered. More information to come.

Madison’s Bike Week will feature big, well-established events such as Ride the Drive and Bacon on the Bike Path, as well as Bike Stations with free treats or bike checks, organized bike rides, or special Madison Bike Week offers from local businesses.

The Madison Bikes vision is a city where anyone can ride to any place comfortably and conveniently, and Madison Bike Week is an important part of making that vision a reality.

Bike Week celebrates riding to work, to school, to a park, to the library — or biking to feel the warm wind blowing through your hair.

There are lots of ways for you to get involved with the biggest celebration of bikes in our city. Check out Madison Bike Week website for more information and to see all of their events: https://www.madisonbikes.org/bikeweek.

Looking for a FREE biking event that the whole family can enjoy? Ride the Drive features entertainment, food, and family-friendly activities at three downtown area parks. On Sunday June 2nd from 11:00am-3:00pm, bike on down to Brittingham Park, Olin Park, and Law Park to enjoy a four-mile bike route filled with fun, family, and friends. To learn more about this event, check out https://www.cityofmadison.com/parks/ridethedrive.

Up for a relaxing coffee, muffin, and bicycle filled morning? Come on down to the corner of Monona Dr and Buckeye Rd to Lake Edge Shopping Center to enjoy breakfast snacks, friendly conversations, and bike checks courtesy of Crema Café and Slow Roll Cycles. For more information check out: https://www.madisonbikes.org/bikeweek

A bite to eat, and a quick bike tune-up before your ride to work will surely start your day off right. Join Slow Roll Cycles and Crema Cafe all week (June 3rd-7th) for this fun bike experience!

Are you excited for spring weather? Does your bike need a tune up? Come to the University Bicycle Resource Center for free access to air pumps, bike grease, lube, and many other useful tools to get your bike ready for spring time biking festivities!

Bike Air and Repair Stations are located all around campus.

What the University Bicycle Resource Center offers:

Visit: Transportation Services – Bike Resource Center for more information!

Facilities Planning & Management is currently recruiting for an Assistant Vice Chancellor of Environment, Health & Safety.

Reporting to the Associate Vice Chancellor of FP&M, this leadership position will be responsible for providing innovative and strategic leadership for a comprehensive university-wide environmental, health and safety (EH&S) program. The program impacts the teaching and research mission of university, the university community, and the operations of FP&M. The Assistant Vice Chancellor has oversight and lead responsibility for university compliance to applicable laws and regulations; key environmental, health and safety implementation programs. This includes, but is not limited to; compliance requirements or programs to implement applicable environmental, health and safety laws, and regulations for laboratory safety and health; occupational safety; health and medicine; biological safety and health; select agent programs; chemical safety and health; radiation safety and health; environmental compliance; fire prevention and fire life safety; industrial hygiene; ergonomics; food safety; environmental health; general safety; and other areas as assigned. The Assistant Vice Chancellor also serves on multiple committees supporting safety, health, environmental compliance, and research compliance.

Applications are due on February 8, 2018.

For more information, consult the position vacancy listing.

Are you on track saving for your future? Take advantage of these free events. The UW Tax-Sheltered Annuity 403(b) Program is your supplemental retirement savings plan.

INDIVIDUAL COUNSELING SESSIONS

Please check “Today In The Union” the day of your individual counseling session for the room at Union South and Memorial Union. Sessions are from 9:00 a.m.-4:00 p.m. with each session 45 minutes. Having an individual counseling session does not obligate you to open an account. Or, if you have an account, make an appointment to discuss if you’re on track saving for retirement.

FIDELITY INDIVIDUAL COUNSELING SESSIONS

To schedule an appointment, call 1-800-642-7131 or go to http://fidelity.com/atwork/reservations.

TIAA INDIVIDUAL COUNSELING SESSIONS

December 14, 2018 (UW System Administration, 780 Regent Street, room 121)

To schedule an appointment, call 1-800-732-8353 or go to https://publictools.tiaa-cref.org/public/publictools/events/eventswelcome.

Lincoln has advisors in Madison at 406 Science Drive, Suite 310. For a Lincoln appointment, call 608-238-8388.

Ameriprise has advisors in Madison at 2601 West Beltline Hwy., Suite 104. For an Ameriprise appointment, call 608-819-0500.

Rowe Price provides individual counseling sessions over the phone. To speak to a T. Rowe Price representative, call 1-888-263-2899.

SELECT, SIGN UP AND SAVE WITH YOUR UW TSA 403(b) WORKSHOP

Monday, December 10, 2018, 10:00 a.m.-11:00 a.m., 21 North Park Street, room 1106

Come to this workshop to learn about your UW TSA 403(b) Program, your supplemental retirement savings program. A TSA provider representative will review some great reasons to save with your TSA 403(b) and discuss why you should save for retirement. Along the way, you’ll get some wit and wisdom on saving from Ben Franklin. Find out how your TSA 403(b) can help you prepare for retirement and about the importance of starting now! After attending this workshop, you will be ready to take the next steps to start. Please go to the UW-Madison TSA 403(b) Workshop webpage to register.

Are you on track saving for your future? Take advantage of these free events. The UW Tax-Sheltered Annuity 403(b) Program is your supplemental retirement savings plan.

INDIVIDUAL COUNSELING SESSIONS

Please check “Today In The Union” the day of your individual counseling session for the room at Union South and Memorial Union. Sessions are from 9:00 a.m.-4:00 p.m. with each session 45 minutes. Having an individual counseling session does not obligate you to open an account. Or, if you have an account, make an appointment to discuss if you’re on track saving for retirement.

FIDELITY INDIVIDUAL COUNSELING SESSIONS

To schedule an appointment, call 1-800-642-7131 or go to http://fidelity.com/atwork/reservations.

TIAA INDIVIDUAL COUNSELING SESSIONS

To schedule an appointment, call 1-800-732-8353 or go to https://publictools.tiaa-cref.org/public/publictools/events/eventswelcome.

Lincoln has advisors in Madison at 406 Science Drive, Suite 310. For a Lincoln appointment, call 608-238-8388.

Ameriprise has advisors in Madison at 2601 West Beltline Hwy., Suite 104. For an Ameriprise appointment, call 608-819-0500.

Rowe Price provides individual counseling sessions over the phone. To speak to a T. Rowe Price representative, call 1-888-263-2899.

FP&M trades employees will now earn $0.80 per hour for all weekend hours worked (i.e., 12:01 am on Saturday to 12:00 on Sunday). No additional action is required; the payroll system will automatically generate the weekend differential.

For more information about this change, contact FP&M Human Resources.

Due to tax liability implications of the Tax Cuts and Job Act passed by the Federal Government effective January 1, 2018, the UW System will need to change your pre-tax payroll deductions for parking, vanpool, and bus passes. Starting with payrolls dated on or after June 1, 2018, these fees will be deducted on a post-tax basis for all UW System employees.

Because of the federal tax law changes, UW employees will not be able to create Parking and Transit Accounts, as administered by TASC. If you have an existing Parking and Transit Account, funds cannot be added for payrolls dated on or after June 1, 2018. Any funds withheld prior to June 1 are still available to be used for parking and transit purposes until exhausted or you become ineligible for the plan(s).

The changes to the Parking & Transit Accounts administered by TASC do not affect any other plans administered by TASC (i.e., Flexible Spending Accounts and Health Savings Accounts).

If you have additional questions, please contact FP&M Human Resources or the UW Office of Human Resources.

As a result of the Federal Tax Reform bill passed in December of 2017, many UW-Madison employees had a change in their federal income tax withholding beginning with the February 1st, 2018 paycheck. The new federal tax withholding is based on the updated tax tables from the IRS and the most recent form W-4 received. You can see your current tax withholding status and the number of the allowances you are claiming for federal and state in the upper right corner of your earnings statement in the box labeled “Tax Data.” Beneath that section under “Taxes” you can see your year to date (YTD) withholding as well as your per paycheck (current deductions) federal tax withholding.

The Internal Revenue Service (IRS) is encouraging taxpayers to make sure they are having the right amount of tax taken out of their paychecks. Doing a “paycheck checkup” can help prevent you from having too little or too much tax withheld. The IRS offers an online Withholding Calculator to help you determine the right amount of tax withholding for your situation. Find the IRS Withholding Calculator at irs.gov/individuals/irs-withholding-calculator. Taxpayers can also use the long form W-4 worksheet to determine the appropriate withholding status and number of allowances: https://www.irs.gov/pub/irs-pdf/fw4.pdf.

If you would like to make a change in how much federal income tax you have withheld from your paycheck, you will need to update your Form W-4, Employee’s Withholding Allowance Certificate. To fill out a new W-4, log into MyUW and launch the Payroll Information module or schedule an appointment with Rebecca Rohde in the FP&M Payroll & Benefits office (rebecca.rohde@wisc.edu).

The IRS Website has additional information: https://www.irs.gov/newsroom/irs-encourages-paycheck-checkup-for-taxpayers-to-check-their-withholding-special-week-focuses-on-changes.